Cheyenne County Kansas Community Foundation

785-772-5124

Current CCKCF Funds

Click on the fund to learn more!

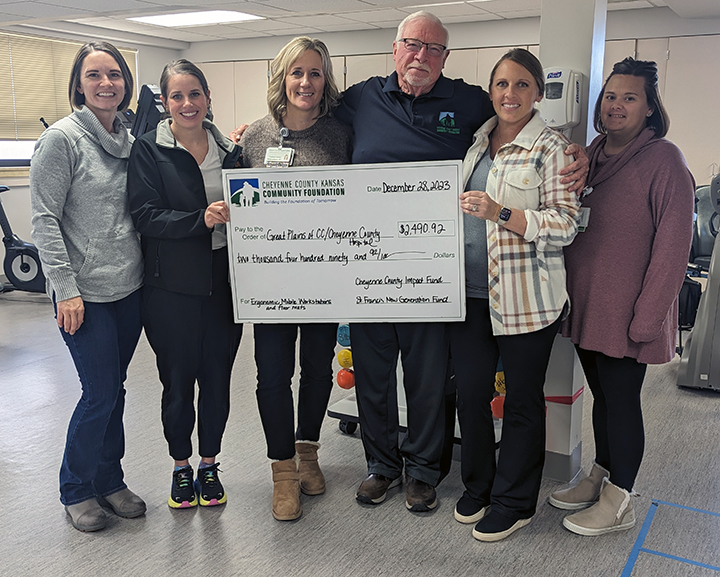

Cheyenne County Impact

In December 2016, the Cheyenne County Impact Fund was established through a matching initiative provided by the Dane G. Hansen Foundation. The goal is to spend the earnings at the rate of 5% of the average 3-year-end Fund balance.

Incoming donations into this endowment fund were eligible for a $1 for $1 match up to $50,000 during the month of December in 2016. In subsequent years, incoming donations were once again matched $1 to $1 up to $50,000 by the Hansen Foundation, and an additional match was offered by Stanion Wholesale Electric Company / the Bill and Cindy Keller Family.

The fund has grown to more than $400,000! Annual matching campaigns have continued to build this endowment fund. As this fund grows, the interest will be used to fund projects throughout Cheyenne County. Click here for more information and to apply!

CCKCF Operating

This Fund supports any charitable cause to benefit residents in Cheyenne County, Kansas and/or the communities within.

CCKCF Operating Endowment

This Fund supports any charitable cause to benefit residents in Cheyenne County, Kansas and/or the communities within.

CCKCF Unrestricted

This Fund supports any charitable cause to benefit residents in Cheyenne County, Kansas and/or the communities within.

St. Francis New Generation Endowment Fund

This Fund mirrors the previous New Generation Fund, Inc. as an endowment fund. Therefore, only the earnings (no principal) from this fund can be spent for charitable purposes for the betterment of St. Francis and Cheyenne County. Currently, the goal is to spend the earnings at the rate of 5% of the average 3-year-end Fund balance.

A portion of the earnings may also be utilized for necessary expenses to educate and promote the work of the Fund. Awards are typically made once per year through a competitive application process. Click here for for more information and to apply!

St. Francis Educational Foundation Fund

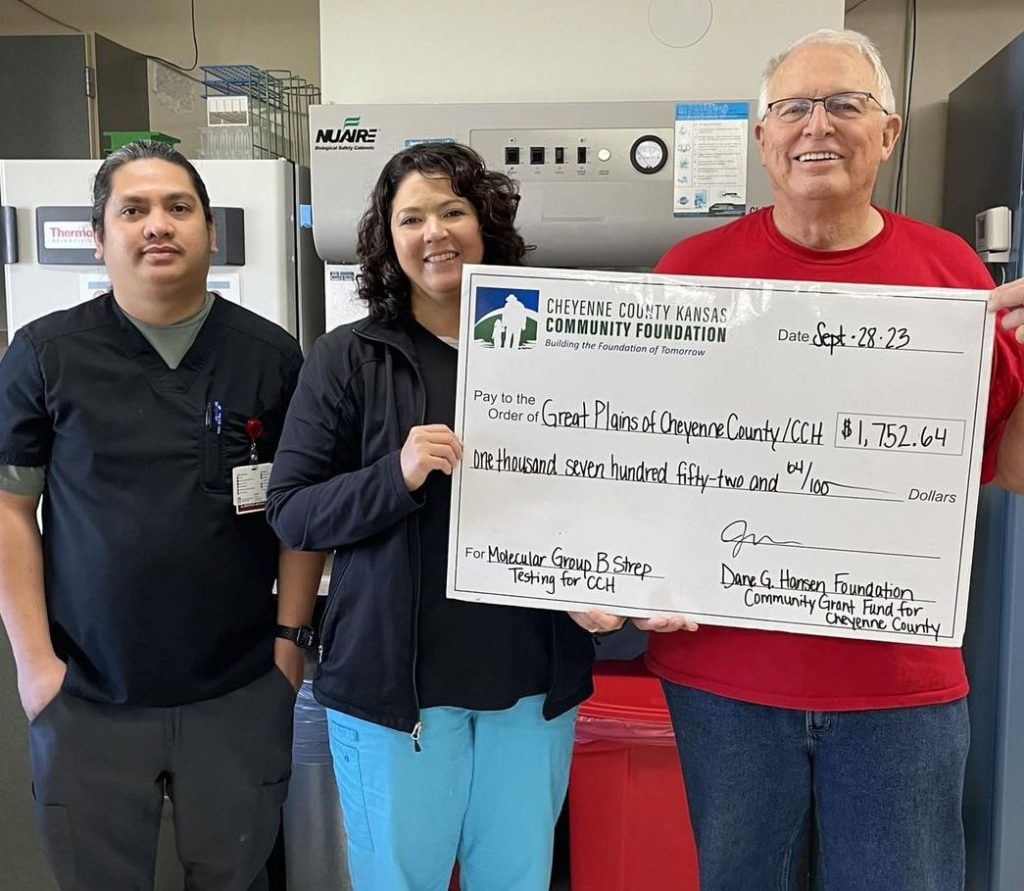

Dane G. Hansen Foundation Community Grant Fund for Cheyenne County

To date, Cheyenne County is one of 26 counties in northwest Kansas that has been awarded eleven rounds of $50,000 grants from the Dane G. Hansen Foundation, with 12 of those county funds established through the Greater Northwest Kansas Community Foundation.

This grant fund was established in March 2015 to allow qualifying 501(c)(3) nonprofit organizations; or educational, governmental or religious institutes per IRS, to apply for funding assistance for projects intended for Cheyenne County benefit. Qualifying entities may apply online; grants are awarded through a competitive application process.

The Hansen Foundation has guaranteed additional rounds of funding to continue through 2021, providing continual county-wide participation in the Cheyenne County Strategic Doing Initiative. Click HERE for more information and to apply!

202 on Washington

LRO Family Fund

Cheyenne County Village

Junior and Deloris Knorr Family

Vic Oelke Memorial Scholarship

Interested in opening a fund? Reach out to our team!

Want to learn more about the funds and their history?

In December 2016, the Cheyenne County Impact Fund was established through a matching initiative provided by the Dane G. Hansen Foundation. Currently, the goal is to spend the earnings at the rate of 5% of the average 3-year-end Fund balance. Incoming donations into this endowment fund were eligible for a $1 for $1 match up to $50,000 during the month of December in 2016. In subsequent years, incoming donations were once again matched $1 to $1 up to $50,000 by the Hansen Foundation, and an additional match was offered by Stanion Wholesale Electric Company / the Bill and Cindy Keller Family. The fund has grown to more than $400,000! Annual matching campaigns will continue through 2021 to build this endowment fund. As this fund grows, the interest will be used to fund projects throughout Cheyenne County. Click HERE for more information and to apply!

This Fund supports any charitable cause to benefit residents in Cheyenne County, Kansas and/or the communities within.

This endowment Fund was established in 2018 to be used for the charitable purpose of supporting the needs of the Cheyenne County Village. Grant recommendations will come from the Cheyenne County Village board of directors. Currently, the goal is to spend the earnings at the rate of 5% of the average 3-year-end Fund balance.

To date, Cheyenne County is one of 26 counties in northwest Kansas that has been awarded eleven rounds of $50,000 grants from the Dane G. Hansen Foundation, with 12 of those county funds established through the Greater Northwest Kansas Community Foundation. This grant fund was established in March 2015 to allow qualifying 501(c)(3) nonprofit organizations; or educational, governmental or religious institutes per IRS, to apply for funding assistance for projects intended for Cheyenne County benefit. Qualifying entities may apply online; grants are awarded through a competitive application process. The Hansen Foundation has guaranteed additional rounds of funding to continue through 2021, providing continual county-wide participation in the Cheyenne County Strategic Doing Initiative. Click HERE for more information and to apply!

To learn more about Strategic Doing, go to https://www.gnwkcf.org/initiatives.

This Fund mirrors the previous New Generation Fund, Inc. as an endowment fund. Therefore, only the earnings (no principal) from this fund can be spent for charitable purposes for the betterment of St. Francis and Cheyenne County. Currently, the goal is to spend the earnings at the rate of 5% of the average 3-year-end Fund balance. A portion of the earnings may also be utilized for necessary expenses to educate and promote the work of the Fund. Awards are typically made once per year through a competitive application process. Click HERE for for more information and to apply!